Get the free gnma full form

Show details

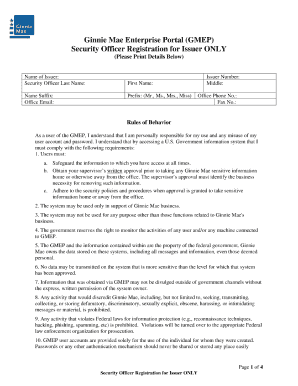

ACH Debit Authorization U.S. Department of Housing and Urban Development Government National Mortgage Association OMB Approval No. 2503-0033 (Exp. 12/31/2013) Public reporting burden for this collection

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign gnma full form

Edit your gnma full form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your gnma full form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit gnma full form online

Follow the guidelines below to benefit from a competent PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit gnma full form. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

It's easier to work with documents with pdfFiller than you can have ever thought. Sign up for a free account to view.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out gnma full form

How to fill out gnma form 11709:

01

Start by entering your personal information such as your name, address, and contact details.

02

Provide your social security number or taxpayer identification number.

03

Indicate the loan number and the borrower's name.

04

Fill in the property address, including the city, state, and zip code.

05

Specify the type of mortgage being insured, such as fixed-rate, adjustable-rate, or graduated payment mortgage.

06

Enter the initial endorsement date and the anticipated closing date.

07

Provide the loan amount, the interest rate, and the term of the loan.

08

Indicate whether the loan is for a one-to-four family property or a manufactured home.

09

Fill out the information related to the mortgagee, including the name, address, and identification number.

10

Sign and date the form to certify the accuracy of the information provided.

Who needs gnma form 11709:

01

Mortgage lenders and servicers who are applying for insurance coverage on government-guaranteed mortgage loans.

02

Borrowers who have obtained a mortgage loan insured by the Government National Mortgage Association (GNMA).

03

Any party involved in the processing and approval of a government-guaranteed mortgage loan, such as loan officers, underwriters, and loan processors.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I create an electronic signature for signing my gnma full form in Gmail?

You can easily create your eSignature with pdfFiller and then eSign your gnma full form directly from your inbox with the help of pdfFiller’s add-on for Gmail. Please note that you must register for an account in order to save your signatures and signed documents.

How can I edit gnma full form on a smartphone?

You can do so easily with pdfFiller’s applications for iOS and Android devices, which can be found at the Apple Store and Google Play Store, respectively. Alternatively, you can get the app on our web page: https://edit-pdf-ios-android.pdffiller.com/. Install the application, log in, and start editing gnma full form right away.

How do I complete gnma full form on an iOS device?

In order to fill out documents on your iOS device, install the pdfFiller app. Create an account or log in to an existing one if you have a subscription to the service. Once the registration process is complete, upload your gnma full form. You now can take advantage of pdfFiller's advanced functionalities: adding fillable fields and eSigning documents, and accessing them from any device, wherever you are.

What is hud 11709 form?

The HUD 11709 form is a document used by the U.S. Department of Housing and Urban Development (HUD) to collect data on property and loan characteristics for FHA-insured loans.

Who is required to file hud 11709 form?

Lenders who originate FHA-insured loans are required to file the HUD 11709 form as part of the loan application process.

How to fill out hud 11709 form?

To fill out the HUD 11709 form, lenders must provide detailed information about the borrower, the property, the loan amount, and other relevant financial data in accordance with HUD guidelines.

What is the purpose of hud 11709 form?

The purpose of the HUD 11709 form is to gather standardized information about FHA-insured loans to help HUD monitor compliance, risk, and overall performance of its housing programs.

What information must be reported on hud 11709 form?

The HUD 11709 form requires reporting various data including borrower details, property information, loan terms, and financial aspects such as income and credit scores.

Fill out your gnma full form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Gnma Full Form is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.